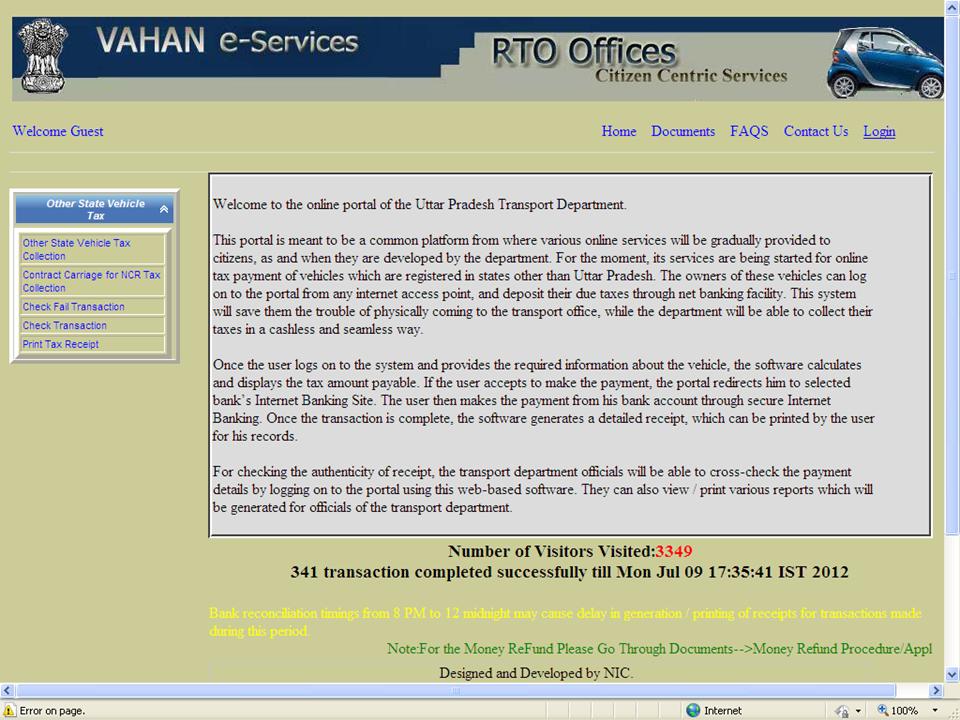

Online Other State Vehicle Tax Payment in Uttar Pradesh

All commercial vehicles entering Uttar Pradesh for a limited period of time have to pay other state vehicle tax at the toll check posts located on state border as per Motor Vehicle Taxation Rules. Continuous transit of vehicles from other states, keeps the toll posts engaged 24x7 and one can witness long queues at the toll counters throughout the day. The vehicles enter the state day and night which requires the tax collection counters to work continuously. Also there are security issues both for the tax collecting officials and government funds collected as tax. The citizens too get hassled at the check post as they have to locate the office and then wait for tax deposition.

UP Transport Department and National Informatics Centre, Uttar Pradesh have jointly developed an online system to take care of the problems faced by the department officials and the citizens. The application enables the vehicle owners to deposit the tax online using the secured website vahan.up.nic.in/checkpost at any time of the day through internet banking.

The software calculates the tax amount based on the parameters of vehicle. If the user accepts to make the payment through NET banking the site redirects the user to the selected bank’s NET Banking option. The user makes the payment and the software generates a receipt, which can be printed by user and reproduced at the check post. The transport department officials and the enforcement agencies can verify the payment made through Net banking using the web based interface.

The web site has also been integrated with SMS service. Information of toll tax deposition and authenticity of transaction can be verified by sending registration number of vehicle through SMS to the pre defined number. NCR region vehicles can also avail the facility provided by the software.

The revenue collected through this web site is deposited on same day by the bank (State Bank of India) to UP Transport department’s government (Treasury) account.

Subscribe

Subscribe

Flipbook

Flipbook PDF (5.0 MB)

PDF (5.0 MB)