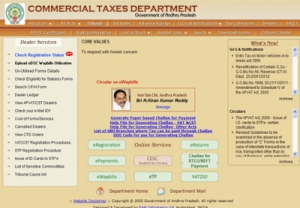

Commercial Taxes Department, Andhra Pradesh

Commercial Taxes Department of Government of Andhra Pradesh contributes more than 65% to the State Revenues. It is the biggest and main bread earner for the State and main function of the department is administration of Value Added Tax (VAT), Entertainment Tax and Profession Tax. As part of this vision, department is providing Tax Payers Services through Online System in addition to other channels to give choice to dealers to opt for a se rvice channel which is more convenient to him and also to reduce avoidable physical interface between citizen and tax office. The website delivers comprehensive information with quick navigation. It is highly user friendly and requires SSL authorization to access, where IP is recorded for a session. The major ICT initiatives of the Department, available online are: eRegistration: Dealers can file their application Online through Internet and they can send documents to Tax Office through Post. Registration Certificate is dispatched to dealer place through post. Prospective dealers have choice as per their convenience to choose Tax Office or Central Registration Unit (CRU) or Online System. eReturn: Dealers can file their Tax Return through Internet from any place on 24X7 basis even on holidays and make payment Online through Internet Banking account. ePayment: Dealers make payment online without visiting Tax office and the tax is realized by the Government next day itself. Computer Dealer Service Centre (CDSC) & eWaybill: The dealers can fill up goods transaction details for which they desire Waybill online and selfprint the Waybill on 24X7 basis.

Subscribe

Subscribe

Flipbook

Flipbook PDF (5.0 MB)

PDF (5.0 MB)