The Integrated Financial Management System (IFMS) is a unified digital platform designed to streamline and modernize public financial management for the Government of Rajasthan. It integrates core functions including budgeting, expenditure control, revenue collection, and accounting to enhance transparency, efficiency, and accountability.

The Integrated Financial Management System (IFMS) is a flagship e-Governance initiative by the Government of Rajasthan, aimed at establishing a seamless, transparent, and efficient financial management framework across all departments. Designed as an end-to-end digital platform, IFMS unifies multiple financial functions under one umbrella—transforming how the state plans, executes, monitors, and audits public funds.

By integrating core modules such as budgeting, treasury operations, revenue collection, works management, pension processing, and digital payments, IFMS enhances accountability, accelerates service delivery, and reduces manual intervention. It is the backbone of Rajasthan’s financial governance ecosystem.

Key Functionalities

Budget Management

Comprehensive lifecycle coverage: estimation, preparation, allocation, distribution, and printing.

- Integration with departmental demands and schemes.

- Enables real-time budget monitoring and control.

Treasury Authorization & Accounting

- Automated tracking and authorization of financial transactions.

- Centralized treasury control for expenditure management.

- Enables timely and error-free disbursal of funds.

Revenue Management

- End-to-end digitization of receipt workflows—from collection to reconciliation.

- Supports multi-channel payments including Net Banking, UPI, Credit/Debit Cards.

- Enables real-time revenue tracking for better fiscal planning.

Bill Preparation & Processing

- Digital workflow for bill generation, vetting, approval, and submission.

- Integrated with digital signature mechanisms.

- Streamlines communication between DDOs and Treasuries.

Electronic Payments & Direct Benefit Transfers (DBT)

- Secure, real-time transfer of funds to individuals, vendors, and service providers.

- Integrated with RBI’s e-Kuber platform for central payments.

- Supports Aadhaar-enabled payment systems and PFMS validation.

Civil Pension Management

- Automated pension lifecycle: application, sanction, calculation, and disbursement.

- Ensures timely crediting of pension with audit-ready records.

- Digital storage of service books and pension documents.

Online Reconciliation of Accounts

- Daily reconciliation between Treasury, RBI, Banks, and Departments.

- Ensures data integrity and real-time validation of transactions.

Stamps Inventory Management

- Digitized stock control of stamp papers and court fee stamps.

- Enables tracking across collection points and authorized vendors.

Works Management

Covers end-to-end project financial management:

- Administrative and Financial Sanctions (A&F)

- Technical Sanctions (TS)

- Measurement Books (MB)

- Schedule of Rates (BSR)

- Contractor bill generation and payment.

Integrated with PWD and Water Resources departments.

E-Accounting & Document Management

- Paperless accounting process.

- Central repository of financial documents with digital workflow.

- Facilitates internal audit and public accountability.

Single Nodal Account (SNA) Management

- Centralized fund flow for Centrally Sponsored Schemes (CSS).

- Adheres to Government of India’s SNA framework.

- Enables real-time tracking of releases, utilization, and balances.

SNA-SPARSH Module

- Specialized module under IFMS for CSS fund management.

- Tracks scheme-wise allocation, beneficiary targeting, and fund utilization.

- Compliant with Ministry of Finance guidelines.

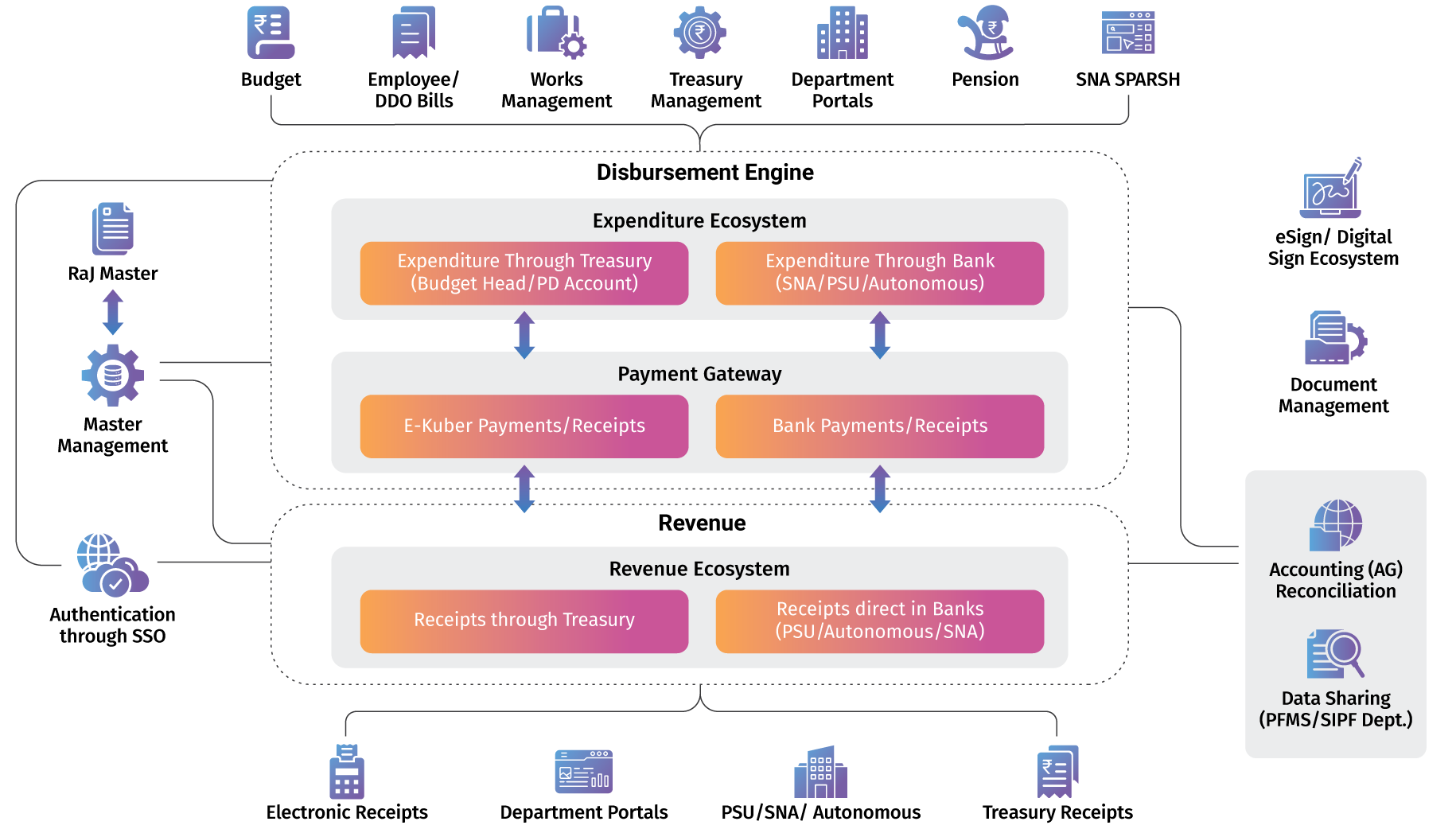

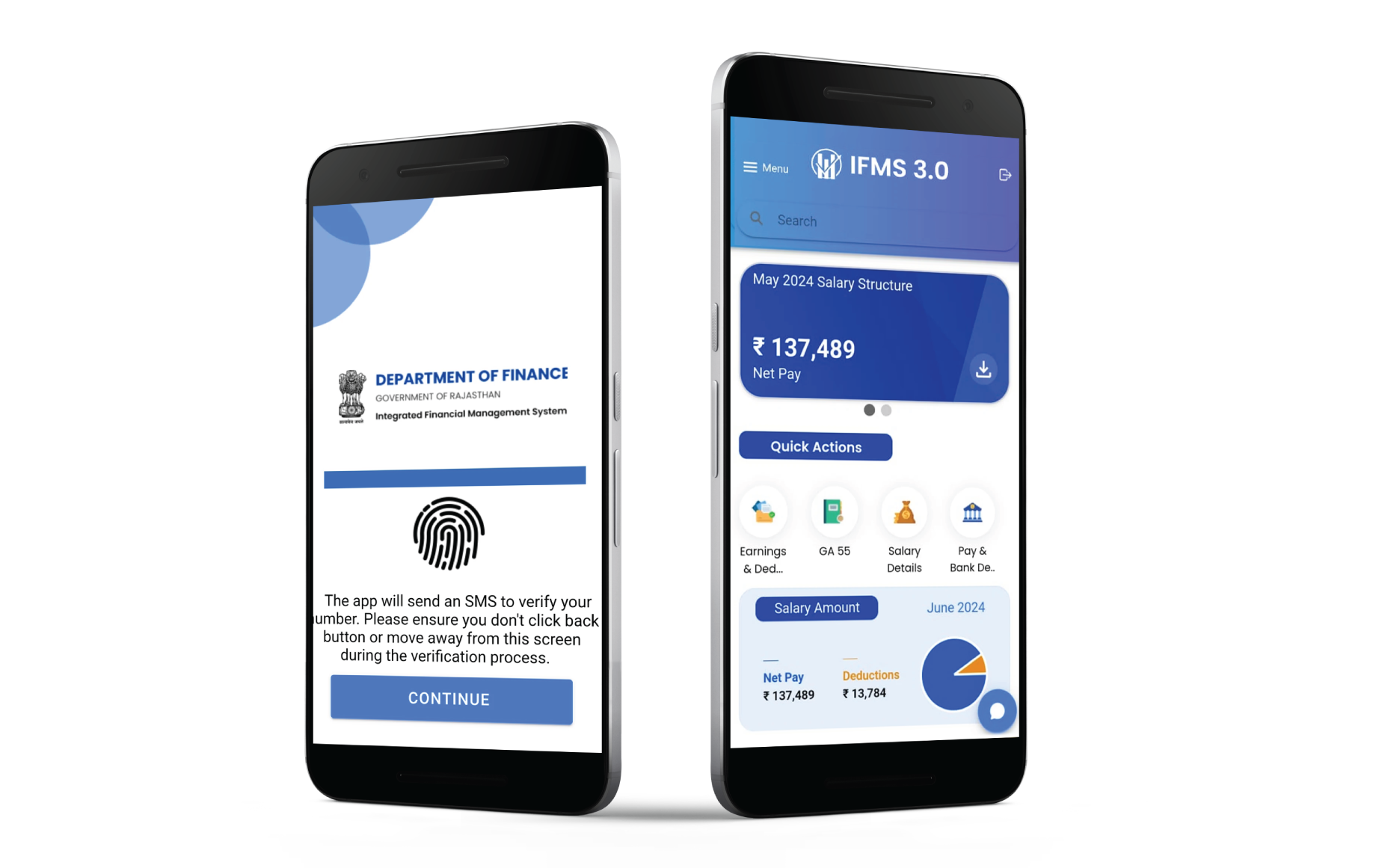

Fig : IFMS 3.0

Fig : IFMS 3.0

System Integration & Payment Infrastructure

IFMS integrates seamlessly with key government departments and acts as a statewide payment gateway, enabling transactions via:

- Net Banking, UPI, Debit/Credit Cards

- Integration with RBI’s e-Kuber and PFMS for CSS fund flow

- Electronic Data Exchange with departmental applications for bill processing and reconciliation

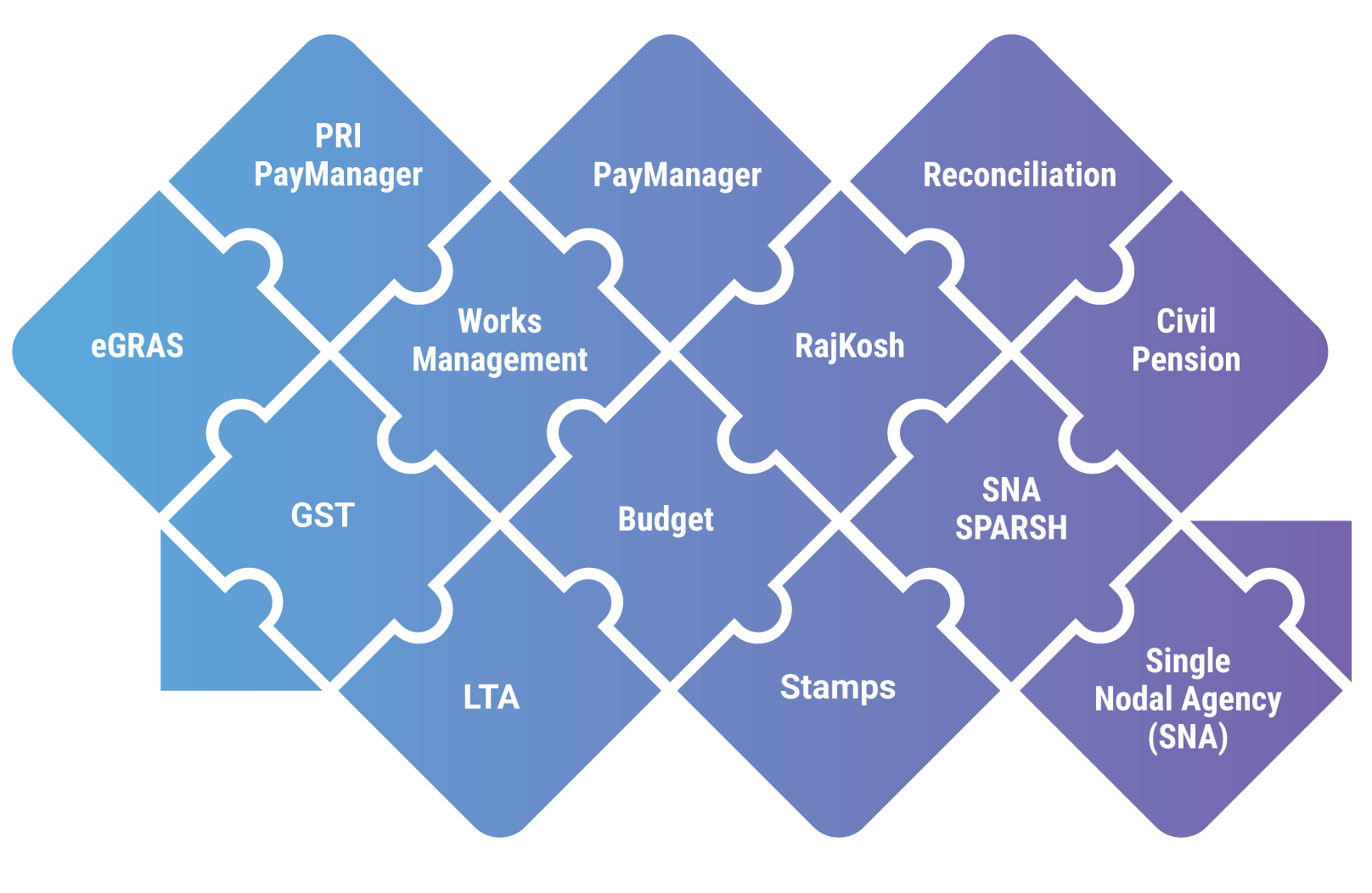

Fig : IFMS : Tightly Integrated Suite of Applications

Fig : IFMS : Tightly Integrated Suite of Applications

Innovations & Enhancements

Paperless Workflow

- Bills move digitally from departments to treasuries and onward to the Accountant General (AG), eliminating manual paperwork and delays.

Automated Salary Processing

- Complete automation of salary bill preparation, verification, and digital payment—no manual intervention required.

E-Accounting & Digital Submissions

- Real-time submission of digital accounts to the AG Office

- All bills are digitally signed to ensure authenticity and security.

Electronic Payments & Reconciliation

- Direct integration with RBI’s e-Kuber platform for secure fund transfers and auto-reconciliation.

- A dedicated State Treasury Payment Gateway enables smooth and transparent financial transactions.

Budget Control & Standardization

- Simplified budget proposal formats.

- Uniform challan and bill formats implemented statewide.

- Automatic Pro Rata calculations for efficient and consistent budget distribution.

Departmental Integration

IFMS is linked with major departments including:

- Agriculture, Social Justice, ICDS, Scholarships, Works, Excise, Commercial Tax, IGRS, SIPF, and Rajkosh for seamless data exchange and financial processing.

E-Governance Payment Solutions

- e-GRAS serves as the centralized gateway for all government receipts.

- Multiple payment modes supported: Net Banking, UPI, Credit/Debit Cards.

- Manual payments (OTT) authorized for SBI, PNB, and CBI branches.

- 100% mandatory e-GRAS challan generation enhances financial transparency.

- E-Treasury System manages electronic receipt and deposit workflows.

Citizen Service Integration

- IFMS is integrated with platforms like Land Records, IGRS, RPSC, Transport, Mines, Excise, and eMitra, enabling citizens to transact digitally.

Operational Efficiency

- Single DDO & Treasury model simplifies monthly salary and bill payments.

- Direct Benefit Transfers (DBT) ensure direct, real-time payments to beneficiaries.

Digital Accessibility

- Single Sign-On (SSO) for unified access to financial systems.

- SMS alerts keep users informed of transactions and updates.

- Mobile governance support allows financial operations via smartphones.

National System Integration

- Integrated with PFMS for centrally sponsored schemes (CSS).

- SNA & SNA-SPARSH modules ensure centralized and trackable fund flow for CSS programs.

These advancements in IFMS reinforce efficiency, transparency, automation, and accountability in Rajasthan’s financial ecosystem, driving a truly paperless and digitally empowered governance model.

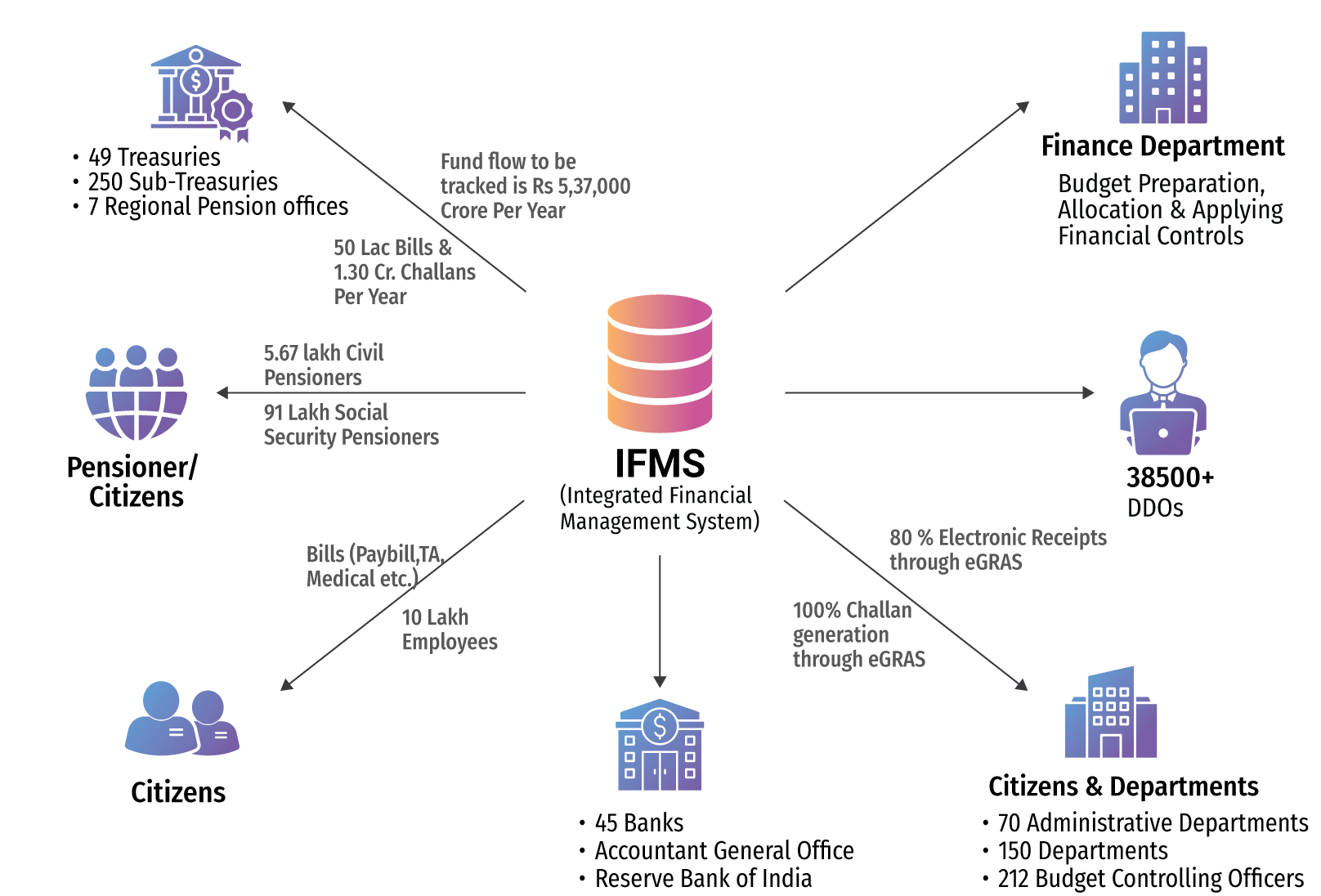

Fig : IFMS : The Financial Manager of Government

Fig : IFMS : The Financial Manager of Government

Technology Stack

- Frontend: Angular

- Backend: Java, Helidon

- Database: Oracle

Impact

- Automation of salary workflows has drastically reduced processing time through paperless, end-to-end digital submission—eliminating manual handling.

- Digital submission of accounts and bills has significantly reduced paper usage and physical file movement.

- Adoption of electronic payment systems has led to substantial savings in time, paper, and administrative effort.

- Employees can now access pay slips, and submit medical and travel allowance (TA) bills online, reducing dependency on physical offices.

- Automation of bill preparation and integration with departmental systems has decreased the need for manual processing and staff involvement.

- Payments made via the RBI’s e-Kuber platform result in estimated annual savings of ₹100 crore for the state.

- Payments made via the RBI’s e-Kuber platform result in estimated annual savings of ₹100 crore for the state.

- System-driven reconciliation ensures higher accuracy and less time spent on verifying financial records.

- Use of standardized forms and workflows across departments has improved service delivery and reduced procedural complexity.

- Automated budget mechanisms enhance allocation accuracy and ensure disciplined fiscal management.

- Instant access to revenue and expenditure data supports more informed planning and decision-making at all levels.

- All stakeholders—including employees, vendors, and Drawing and Disbursing Officers (DDOs)—can track payment and bill status online, ensuring openness in public fund disbursement.

- Automation has minimized transfer entries by reducing errors in head-of-account classifications during transactions.

Fig : IFMS 3.0 Mobile App

Fig : IFMS 3.0 Mobile App

Way Forward

IFMS stands as a vital pillar in the state’s journey toward digital governance, transforming public financial management through transpar ency, precision, and real-time data access. As it continues to evolve, the future vision of IFMS fo cuses on deeper integration, advanced automa tion, intelligent data utilization, and citizen-cen tric scalability—fully aligned with the aspirations of Digital India and the principles of Good Gov ernance.

Looking ahead, IFMS is set to transcend its role as a financial tool to become a powerful enabler of governance transformation. By seamlessly combining technology with transparency, and automation with accountability, IFMS is shaping the path toward a smarter, more inclusive, and resilient financial ecosystem for Rajasthan.

Contributors / Authors

Jitendra Kumar Verma Sr. Technical Director & SIO jk.verma@nic.in

Ishwar Das Variyani Sr. Technical Director id.variyani@nic.in

- Tag:

- Internet

- Technology

- eGov

- Tech

Jitendra Kumar Verma

Senior Technical Director & SIO

NIC Rajasthan State Centre

8318, NW Block, Secretariat, Jaipur

Rajasthan - 302005