Tamil Nadu Rural Development and Panchayat Raj Department is looking after the tax collection of 12,525 Village Panchayats in the state. There are about 1.5 Crore properties in the rural villages of the State and around 50 Lac Water Connection are provided to individual Houses. Nearly 20 Lakh Professional Tax payers are employed in the rural areas of the State. Apart from this, NonTaxes and Trade License are also collected from the concerned citizens. NIC Tamil Nadu State Centre has developed an application for online collection of all these taxes by the Village Panchayaths.

The responsibility for administering and collecting taxes from Village Panchayats in Tamil Nadu lies with the Department of Rural Development and Panchayat Raj (TNRD). In a significant move toward digital governance, the National Informatics Centre (NIC), Tamil Nadu State Centre, has developed a dedicated online platform to facilitate the systematic collection of various taxes levied by Village Panchayats. This comprehensive digital solution, known as the Village Panchayat Tax Portal, is accessible at https://vptax.tnrd.tn.gov.in.

The portal was officially inaugurated by the Hon’ble Chief Minister of Tamil Nadu, Thiru M.K. Stalin, on 26th September 2023, marking a transformative step in strengthening grassroots level fiscal administration. Since its launch, the portal has been widely adopted, not only by the general public but also by over 30,000 departmental officials, including personnel at the state, district, and block levels, as well as Village Panchayat Secretaries and Presidents.

As of now, the portal hosts data from over 1.5 crore properties, spread across 3.66 lakh rural streets, along with details of nearly 35 lakh water connections. This data has been meticulously entered and managed by the Village Panchayat Secretaries, who play a pivotal role in maintaining up-to-date records. To facilitate administrative control and operational oversight, unique user credentials have been issued to the Secretaries and Presidents of all 12,525 Village Panchayats, enabling them to manage tax demands, monitor collections, and generate reports.

The portal empowers citizens to pay taxes online from the comfort of their homes. It also supports payments through counters at Panchayat offices and via Point-of-Sale (POS) devices, which are deployed at the village level to enable doorstep collection and real-time digital receipts. The wide range of payment options, combined with a user-friendly interface, has significantly enhanced compliance and ease of access.

The portal empowers citizens to pay taxes online from the comfort of their homes. It also supports payments through counters at Panchayat offices and via Point-of-Sale (POS) devices, which are deployed at the village level to enable doorstep collection and real-time digital receipts. The wide range of payment options, combined with a user-friendly interface, has significantly enhanced compliance and ease of access.

Features

Citizen can pay the following Taxes through Village Panchayat Tax Portal.

- Property tax

- Water Charges

- Professional Tax

- Trade License

- Non-Taxes

- Miscellaneous Receipts

Citizen can register in the portal and attach their single or multiple properties for the payment of various taxes. They can view the Tax demand for the Properties, pay their dues and download

NIC Tamil Nadu State Centre has associated with TN Rural Development Department for more than 25 years. Many Software has been developed by NIC and successfully implemented by the department. Now NIC TNSC has developed an online portal for Village Panchayat Tax Collection. Tax Collection has improved many folds and we are to able efficiently monitor the Tax Collection.

P. Ponniah,

IAS

Commissioner, Rural Development &Panchayat Raj Department, Govt. of Tamil Nadu

the receipts. The Tax demand can be accessed by citizen through their mobile number attached to properties or by giving assessment number. The portal is bilingual and demands and receipts are available in Tamil as well as in English. This Application has significantly reduced the work load of Village Panchayat Secretaries.

The collected taxes are transferred to Single Nodal Account (SNA) account which are maintained by State RD for all 12,525 Village Panchayats, for both receipts and expenditure done by Village Panchayats.

The VP-Tax application follows a systematic workflow-based architecture. On receipt of the application, the President marks it to the Secretary for verification. The Secretary verifies the application and returns it to the President for approval. In certain cases, like name transfer, the application will be further forwarded for concurrence by the respective Block Development Officer (BDO).

The application is highly customizable to cater to the needs of individual Village Panchayats. Each Panchayat can decide the tax levy and other charges based on the Village Panchayat resolution. The application provides the facility to configure the same on the system, without any dependency of TN RD headquarters.

A Mobile Application has been developed and installed in Point-of-Sale (POS) Machines which were distributed for Tax Collection in all Village Panchayats. Tax Collectors can go and collect the Taxes at citizen doorstep, print the receipt and handover to the citizen. Easy payment options like cash, debit/credit card, UPI, internet payment etc. are provided for the citizen to make the tax payment. All the communications to Citizen happen via SMS and email.

The VP Tax application was seamlessly integrated with Property Registration Portal. Whenever a property is registered in the Property Registration portal, the property details get immediately updated in the Village Panchayat Tax Portal and new Assessment ID is given to the property.

This Application has significantly reduced the work load of Village Panchayat Secretaries. Demand, Collection and Balance (DCB) reports, daily collection report under various categories (Counter, Online, POS collection) and many more reports can be generated at Village, Block, District and State levels.

Technology Stack Used

The VPTAX Application Software is developed in complete Open-Source Technology using Linux, Nginx with Postgres as backend. It is developed as a Responsive Web Design (RWD) using Bootstrap Libraries for easy viewing in mobile also. AlmaLinux 9.5, Nginx 1.25,PHP 8.1 (core PHP), PostgREST for API

| Demand Details | Collection Details | Balance Details | |

|---|---|---|---|

| Property Tax | ₹ 63,251.16 L | ₹ 42,062.93 L | ₹ 21,188.23 L |

| Water Charges | ₹ 36,079.61 L | ₹ 11,951.35 L | ₹ 24,128.26 L |

| Profession Tax | ₹ 26,325.61 L | ₹ 21,933.11 L | ₹ 4,392.50 L |

| Non Tax | ₹ 23.31 L | ₹ 22.94 L | ₹ 0.37 L |

| Trade License | ₹ 1,740.55 L | ₹ 1,606.09 L | ₹ 134.46 L |

| Miscellaneous | ₹ 35,312.62 L | ₹ 32,972.21 L | ₹ 2,340.40 L |

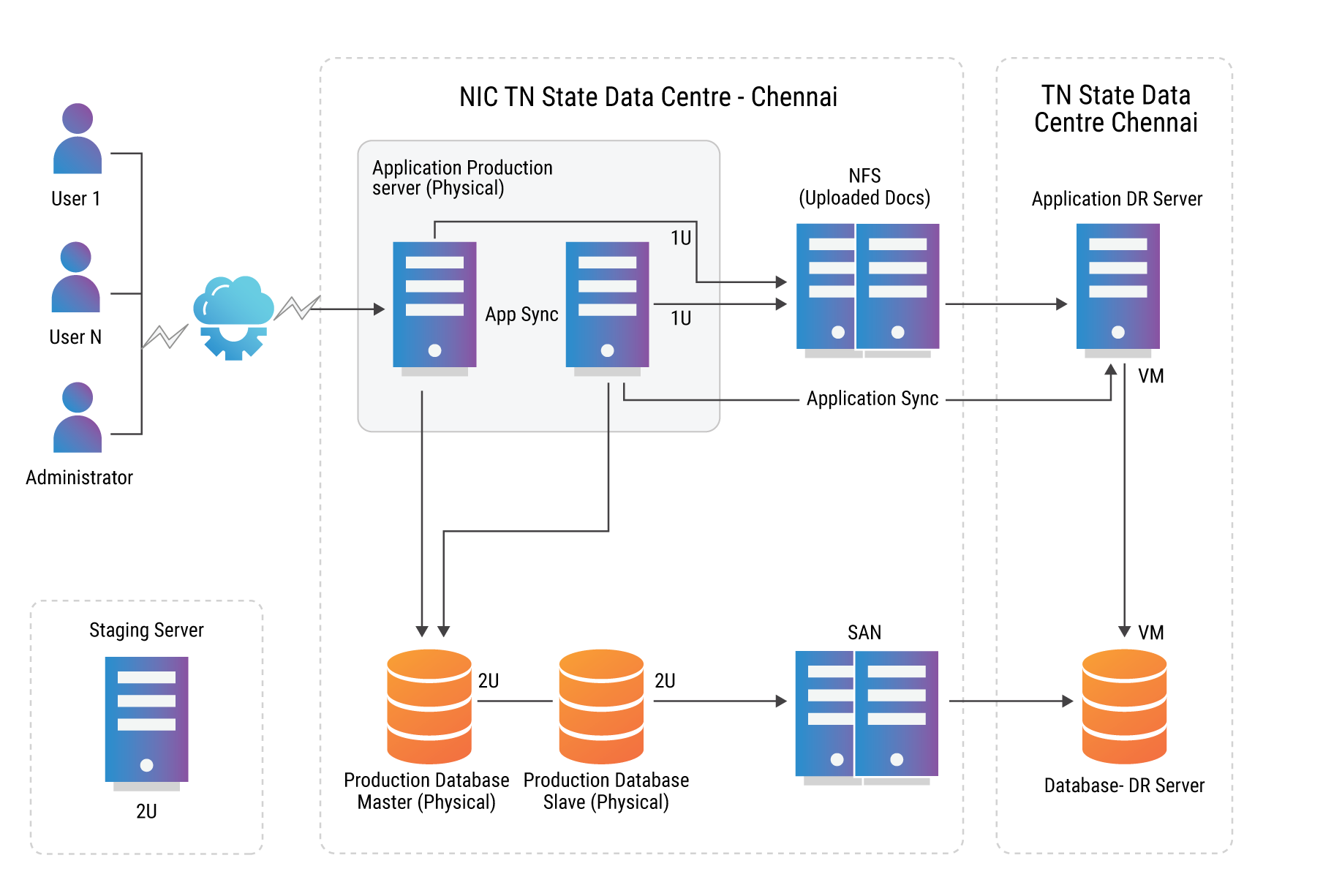

Hardware and Connectivity

Each Village Panchayat has been provided with Desktop machines, Printer, POS Machines. Sufficient Broad Band Connectivity is also provided through ISPs

Fig 10.1: VP Tax online Hardware Architecture

Fig 10.1: VP Tax online Hardware Architecture

Conclusion

The Village Panchayat Tax application has revolutionized collection of all kinds of taxes in Tamil Nadu Village Panchayats. The Tax Collection has improved many folds and the Government is able to centrally monitor the collection across the State. Citizen service will be introduced shortly for New Assessment, Name transfer, Water connection etc., so that citizen can submit their request online without the need to visit the office. A mobile app, named ‘OORAGAM’ (meaning Rural in Tamil), has been developed in local language for payment of all kinds of VP Tax services in Flutter framework for compatibility with Android and iOS. This app will be released shortly.

Contributors / Authors

- Tag:

- Internet

- Technology

- eGov

- Tech

State Informatics Officer

NIC, Tamil Nadu State Centre,

E-2-A, Rajaji Bhavan, Besant Nagar

Chennai, Tamil Nadu - 600090